Property price prediction¶

In this tutorial, you will learn:

- The basics in macroeconomic analysis

- The ways of analyzing macroeconomic indicators

- The ways of analyzing real estate market data

- How to build a property price prediction model

Intro to macroeconomic analysis¶

As we have discussed in the first tutorial, macroeconomic analysis is a way of

investigating the macroeconomic indicators that influence the stock market.

In this module, we will first analyze the macroeconomic indicators and explore how

the indicators affect the stock prices in Hong Kong.

Then, we will specifically analyze the Hong Kong real estate market, as we believe

that it is one of the most important macroeconomic indicator that can reflect the

Hong Kong’s economy.

In addition, we will build a property price prediction model to predict the house price

of Hong Kong.

Macroeconomic indicators in Hong Kong¶

Before proceeding, first import some necessary libraries needed for this module.

import random

import pandas as pd

import matplotlib.pyplot as plt

import seaborn as sns

import pandas as pd

import numpy as np

from sklearn.model_selection import train_test_split

from sklearn.preprocessing import LabelEncoder

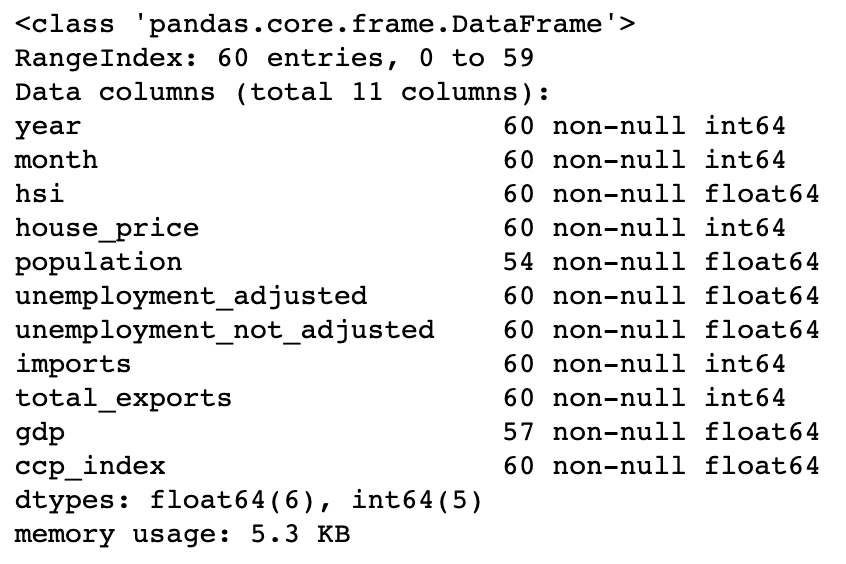

After importing the libraries, let’s have a look at the data. The data contains 8

different macroeconomic indicators collected from 2016 to 2020.

Use

df.info() to print information of all columns.

The column information of macroeconomic data.

Univariate analysis¶

In univariate analysis, use

pandas.Dataframe.describe() to examine the

distribution of the numerical features. It returns the statistical summary such as mean,

standard deviation, min, and max of a data frame.For a better understanding of the statistics summary, use

seaborn.distplot()

to visualise the results with histograms.# Statistical summary

print(df[feature_name].describe())

# Histogram

plt.figure(figsize=(8,4))

sns.distplot(df[feature_name], axlabel=feature_name);

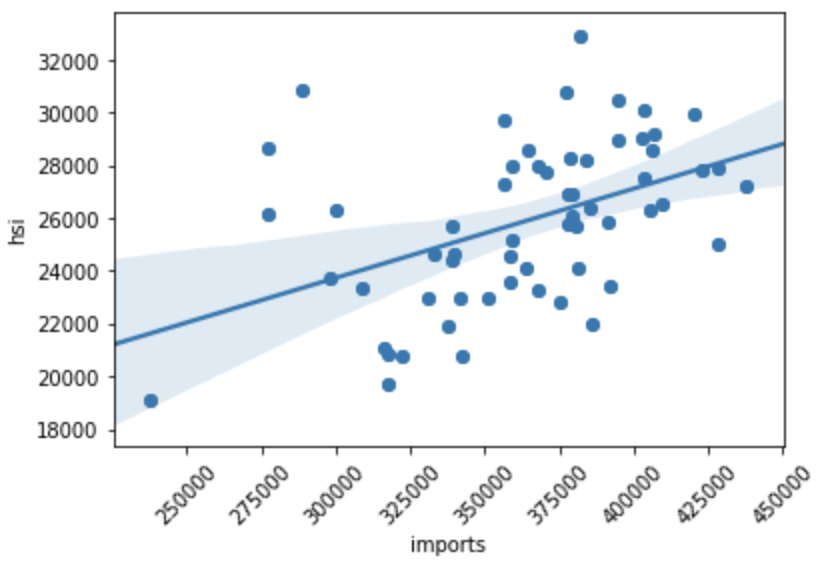

Bivariate analysis¶

In bivariate analysis, we are going to study the correlations between

a macroeconomic indicator and the Hang Seng Index.

Use

matplotlib.pyplot.scatter() and seaborn.regplot() to

visualize the relationship between two features.x = df[feature_name]

y = df['hsi']

plt.scatter(x, y)

plt.xticks(rotation=45)

fig = sns.regplot(x=feature_name, y="hsi", data=df)

An example of a scatter plot with a regression line.

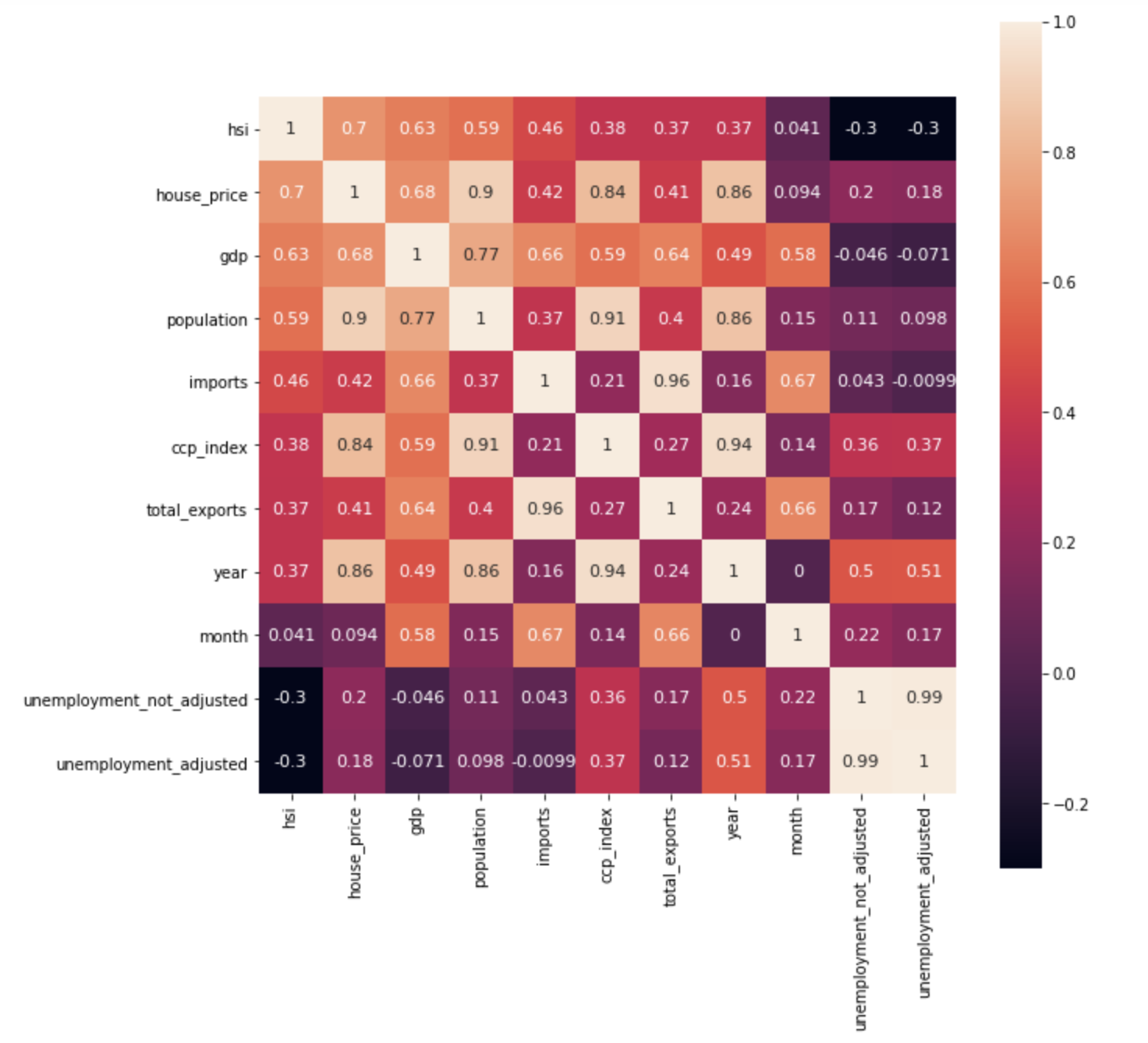

Then, use

pandas.Dataframe.corr() and seaborn.heatmap() to compute

a pairwise correlation of features and visualize the correlation matrix.fig, ax = plt.subplots(figsize=(10,10))

cols = df.corr().sort_values('hsi', ascending=False).index

cm = np.corrcoef(df[cols].values.T)

hm = sns.heatmap(cm, annot=True, square=True, annot_kws={'size':11}, yticklabels=cols.values, xticklabels=cols.values)

plt.show()

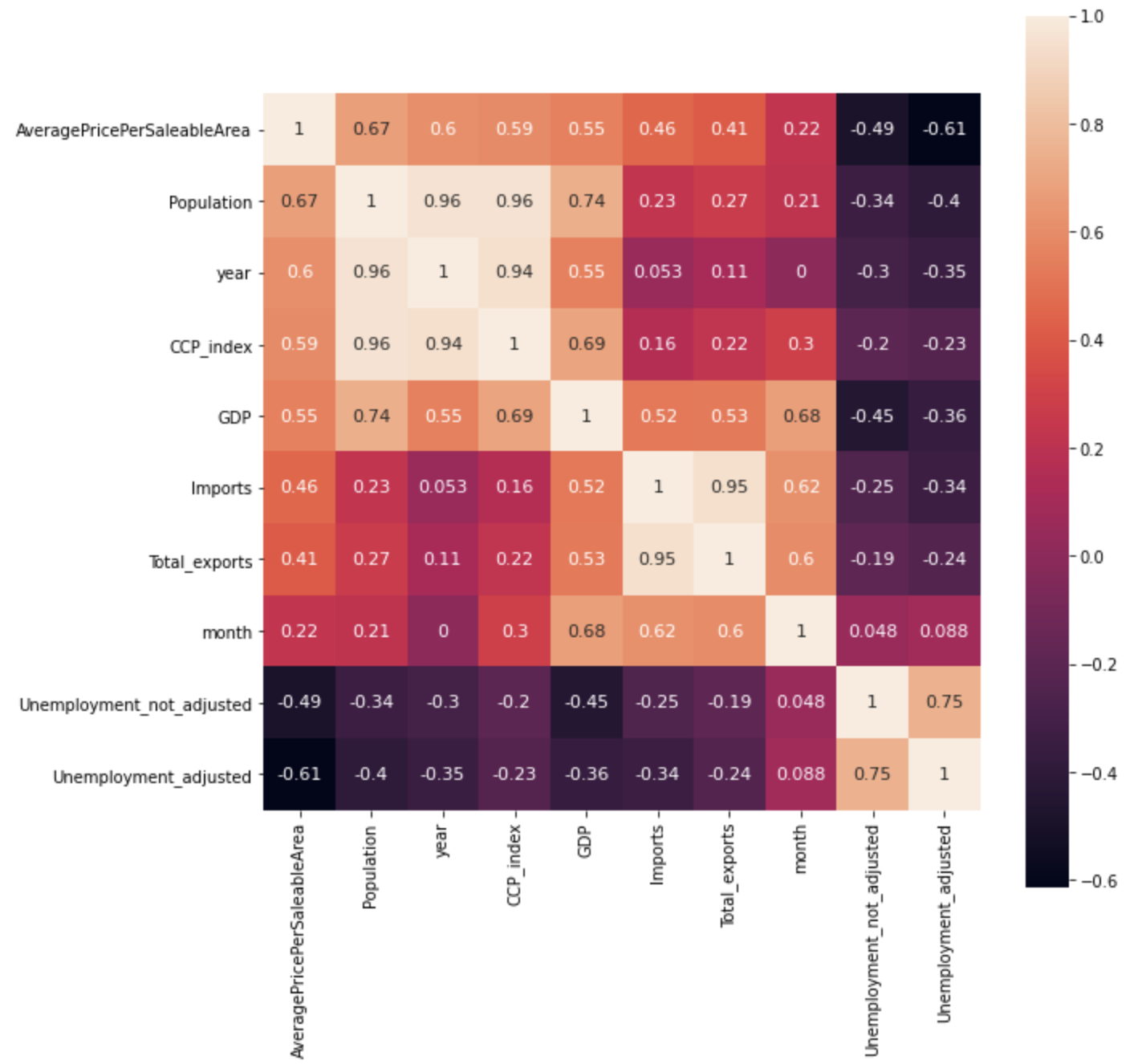

Heatmap - macroeconomic indicators of Hong Kong.

According to the above figure, we can see that house price, GDP, population, imports,

composite consumer price index , total exports, and year are positively correlated to the

Hang Seng index, while both seasonally adjusted unemployment rate and not seasonally

adjusted unemployment rate are negatively correlated to the Hang Seng index.

The Hong Kong real estate market¶

As shown above, the house price in Hong Kong has a strong positive correlation with the

Hang Seng Index. In fact, the properties and construction sector accounts for over 10%

of weighting in the Hang Seng Index (Hang Seng Indexes Company Limited, 2020), and thus

the real estate market data is a source of volatility in the Hong Kong stock market.

While Hong Kong’s real estate market is a constant topic of discussion, it will be worth

analyzing the Hong Kong real estate market data. Using the same data analysis

technique used for the above analysis, we will now analyze Hong Kong residential

market transaction records.

Data pre-processing¶

Before analyzing the transaction records:

1. Derive some useful features from existing features.

# Add new features

df['month'] = pd.to_datetime(df['RegDate']).dt.month

df['year'] = pd.to_datetime(df['RegDate']).dt.year

2. Drop unmeaningful features and features with too many missing values

# Drop unnecessary columns

df = df.drop([feature_name], axis=1)

3. Handle missing values by replacing NAN with a mean value of a feature

# Handling missinig values

# Fill with mean

feature_name_mean = df[feature_name].mean()

df[feature_name] = df[feature_name].fillna(feature_name_mean)

- Label encode categorical features

le = LabelEncoder()

le.fit(list(processed_df[feature_name].values))

processed_df[feature_name] = le.transform(list(processed_df[feature_name].values))

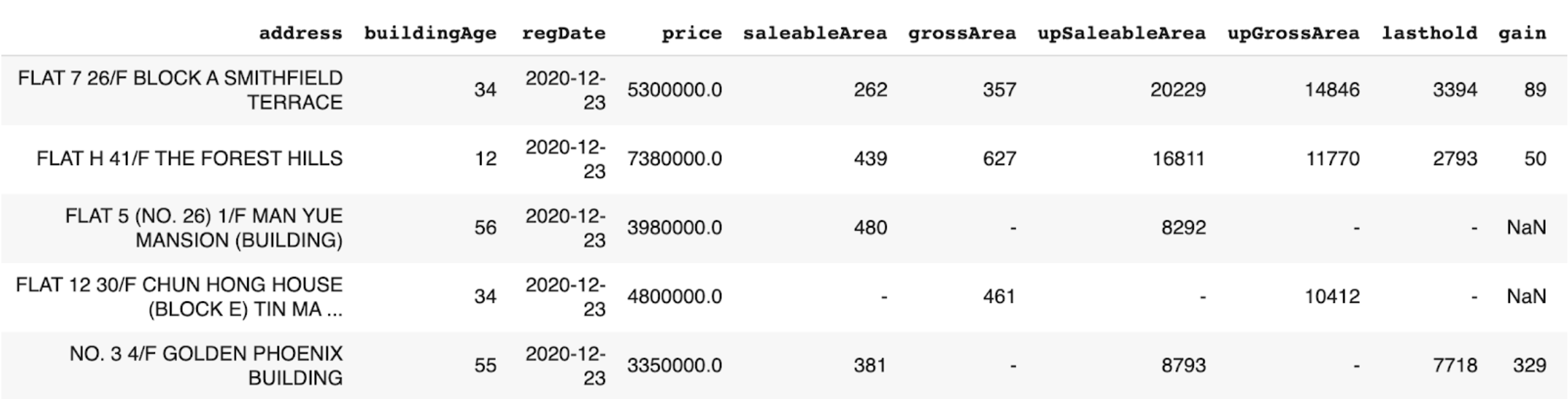

Economic indicator analysis¶

In economic indicator analysis, we will explore how the macroeconomic indicators affect the

monthly average house price per saleable area in Hong Kong.

The transaction records from Centaline Property will be used for this analysis.

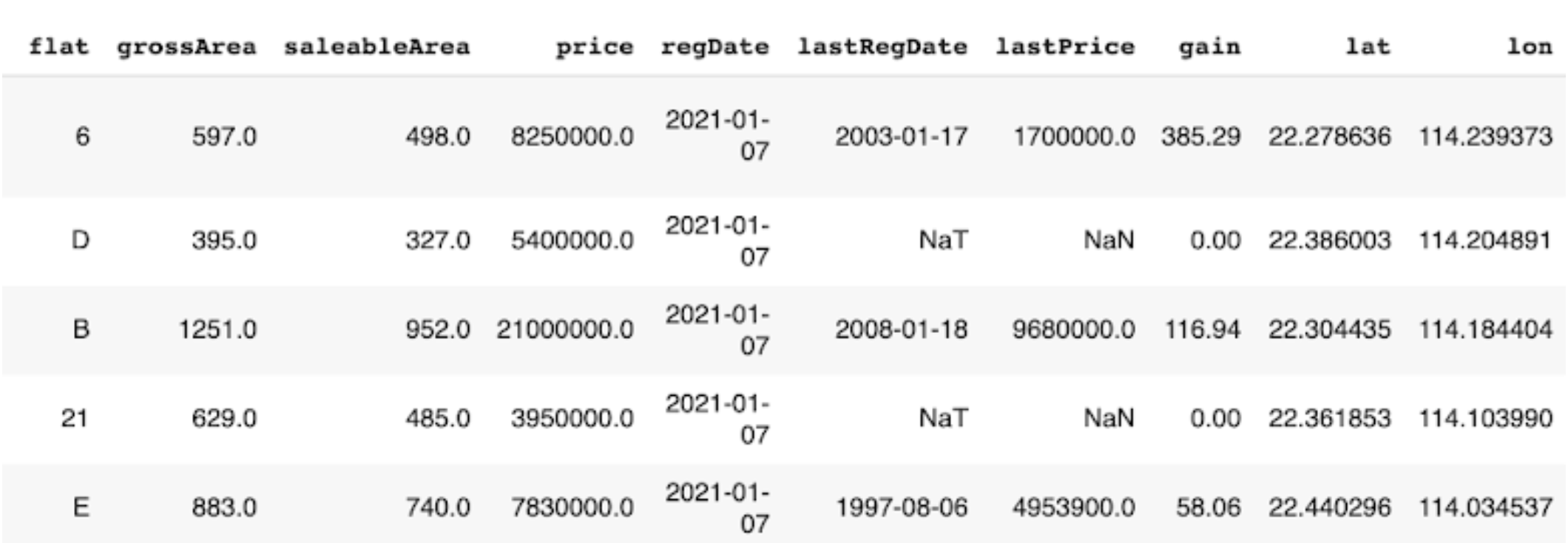

The data structure of transaction record (Centaline Property).

Before analyzing the data, calculate the monthly average house price per saleable area.

Then, join the data with economic indicators by year and month.

# calculate the monthly average house price

df = df.groupby(['year','month'],as_index=False).mean()

df = df.rename(columns={'UnitPricePerSaleableArea': 'AveragePricePerSaleableArea'})

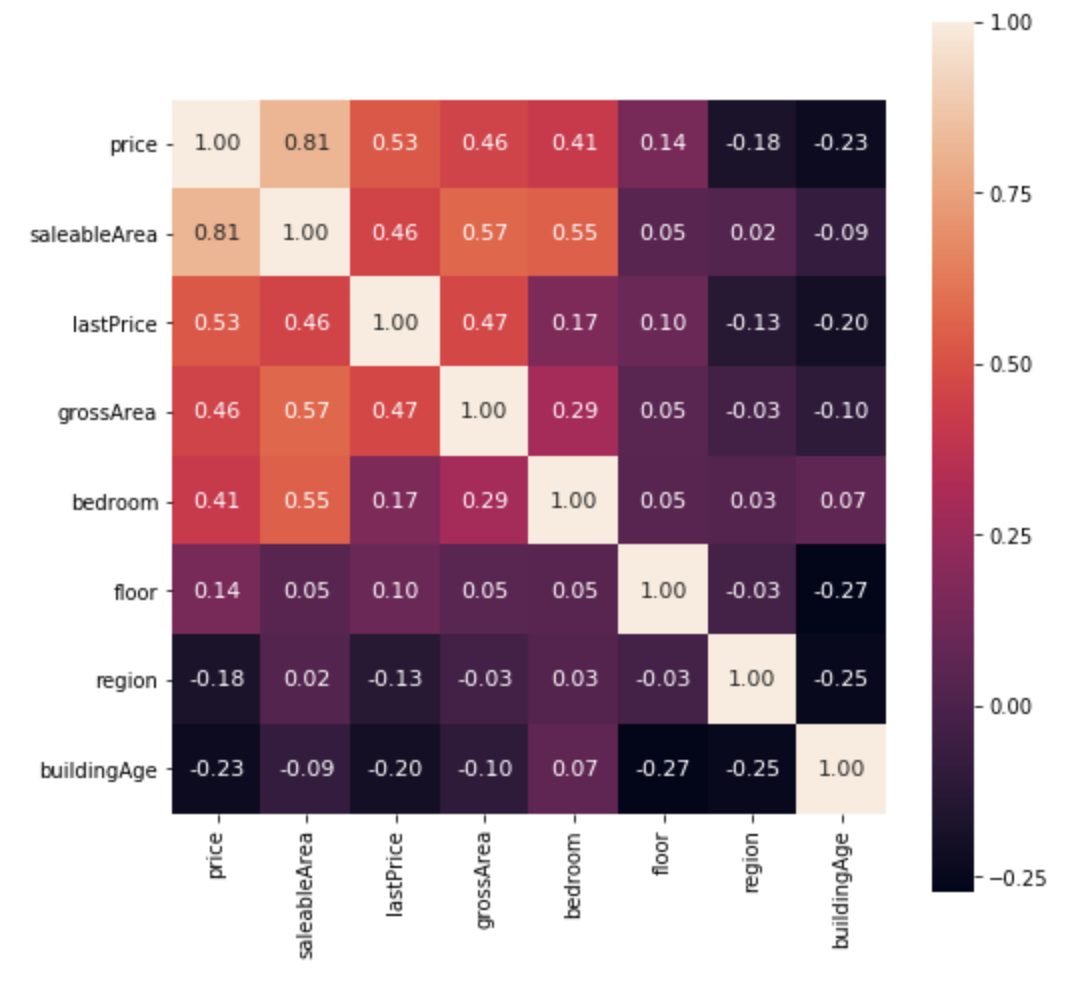

Using the bivariate analysis method we learned, a pairwise correlation of features

is computed and visualized. The result shows that population, year, composite consumer price index,

GDP, imports, and total exports are positively correlated to the monthly average

house price per saleable area in Hong Kong, while both unemployment

rates are negatively correlated to the monthly average house price per saleable area in Hong Kong.

Heatmap - economic indicators analysis.

Transaction record analysis¶

In transaction record analysis, we will examine the relationship between features describing

the house and the individual housing prices of Hong Kong.

The transaction records from Midland Realty will be used for this analysis.

The data structure of transaction record (Midland Realty) - Part 1.

The data structure of transaction record (Midland Realty) - Part 2.

In univariate analysis, the distribution of Hong Kong’s house price is examined.

The housing price of Hong Kong has a mean of 9 million HKD and a standard deviation

of 13 million HKD. The skewness and kurtosis were 26.9 and 1526.4 respectively,

showing that the housing price of Hong Kong is skewed positively to a very high

degree.

# Distribution

print(df['price'].describe())

# Skewness and kurtosis

print("Skewness: ", df['price'].skew())

print("Kurtosis: ", df['price'].kurt())

#output:

count 1.664090e+05

mean 9.133268e+06

std 1.310856e+07

min 5.500000e+05

25% 5.200000e+06

50% 6.830000e+06

75% 9.500000e+06

max 1.399000e+09

Name: price, dtype: float64

Skewness: 26.927207752922435

Kurtosis: 1526.4066673335874

In order to get a better result for the bivariate analysis, outliers are

removed by using standard deviation.

# Calculate mean and standard deviation

data_mean, data_std = np.mean(df[feature_name]), np.std(df[feature_name])

# Calculate upper boundary

upper = data_mean + data_std * 3

# Remove outliers

df = df[df[feature_name] < upper]

In bivariate analysis, the correlation coefficient between the features describing

the house and the house price is computed. 7 features with the highest correlation

is selected and shown below.

Heatmap - transaction data analysis.

According to the above figure, the housing price in Hong Kong has (1) a strong positive

correlation with saleable area; (2) a moderate positive correlation with last

transaction price; (3) a moderate positive correlation with gross area; (4) a moderate

positive correlation with number of bedrooms; (5) a weak positive correlation with

floor; (6) a weak negative correlation with region; and (7) a weak negative correlation

with building age.

The full implementation of the economic indicator analysis and transaction data analysis

could be found in

code/macroeconomic-analysis/ in the repository.Property price prediction with machine learning¶

Based on the transaction data analysis, let’s build property price prediction models.

Train-test split¶

Use

sklearn.model_selection.train_test_split() to split the data with the ratio

of 8:2. The input variables are the top 7 features selected from the analysis, and

the output feature is the house price.feat_col = [ c for c in df.columns if c not in ['price'] ]

x_df, y_df = df[feat_col], df['price']

x_train, x_test, y_train, y_test = train_test_split(x_df, y_df, test_size=0.2, random_state=RAND_SEED)

Log transformation¶

Before training the model, transform

y_train using log function to normalise the highly

skewed price data. In this way, the dynamic range of Hong Kong’s property price can be reduced.log_y_train= np.log1p(y_train)

Training the model¶

In total, 4 different types of predictive models will be built:

- XGBoost

- Lasso

- Random Forest

- Linear Regression

Train the models with

x_train and y_train, and use the

models to make the predictions.import xgboost as xgb

# XGBoost

model_xgb = xgb.XGBRegressor(objective ='reg:squarederror',

learning_rate = 0.1, max_depth = 5, alpha = 10,

random_state=RAND_SEED, n_estimators = 1000)

model_xgb.fit(x_train, log_y_train)

xgb_train_pred = np.expm1(model_xgb.predict(x_train))

xgb_test_pred = np.expm1(model_xgb.predict(x_test))

Evaluate accuracy¶

Then, evaluate the performance of each model by root mean square log error (RMSLE).

The reason why RMSLE is used is because the price values are too big, and RMSLE prevents

penalising large differences between actual and predicted prices.

from sklearn.metrics import mean_squared_log_error

def rmsle(y, y_pred):

return np.sqrt(mean_squared_log_error(y, y_pred))

#output:

XGBoost RMSLE(train): 0.1626671056150446

XGBoost RMSLE(test): 0.16849945199484243

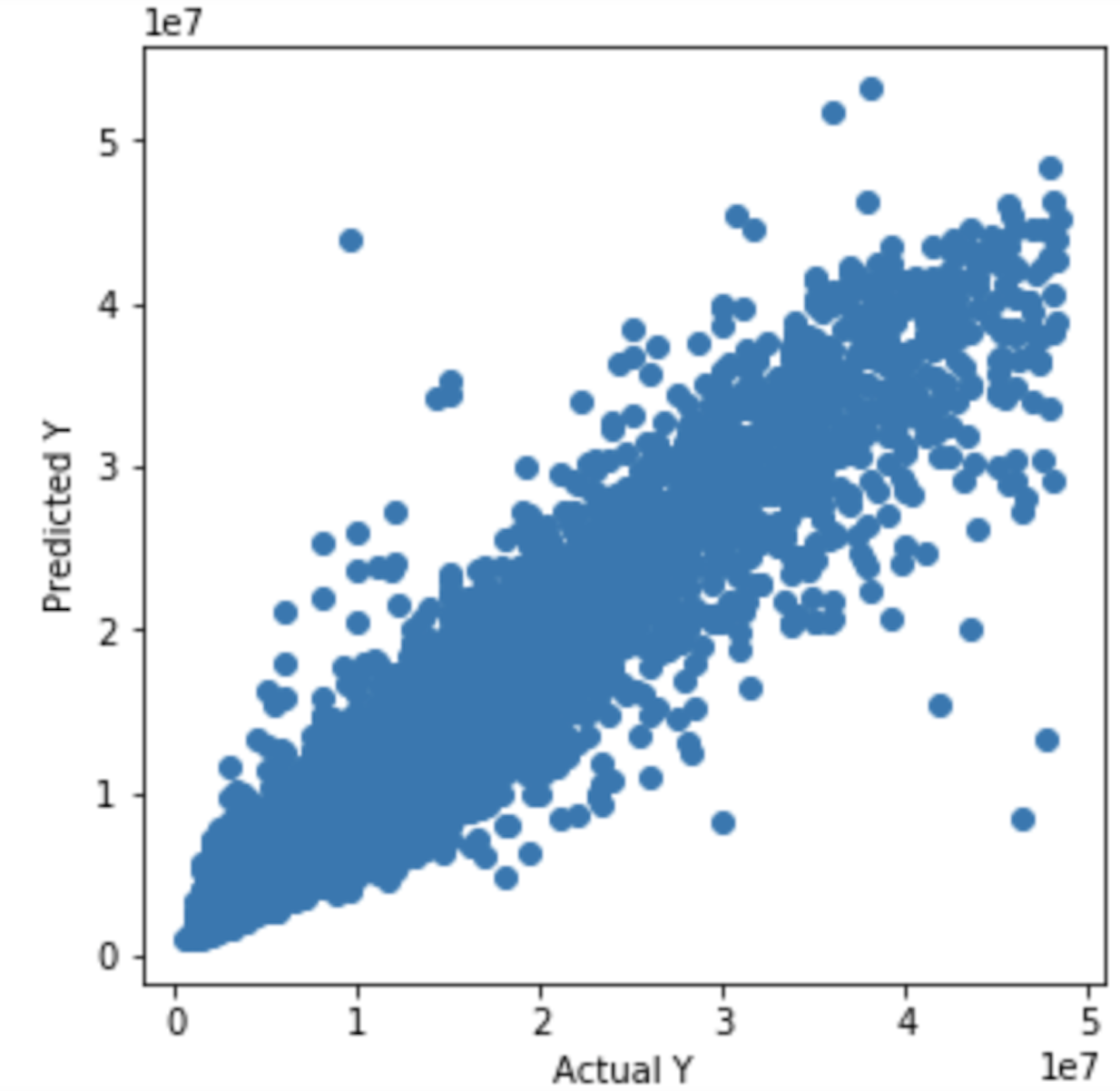

The train model RMSLE and the test model RMSLE are 0.1627 and 0.1685 respectively.

XGBoost uses a more accurate implementation of gradient boosting algorithm and

optimised regularisation, and hence, it gives a better result than other models.

However, in this case, the result shows that the model is slightly overfitting the train data.

The below figure shows the graph of actual and predicted property price for XGBoost.

plt.figure(figsize=(5,5))

plt.scatter(y_test,xgb_test_pred)

plt.xlabel('Actual Y')

plt.ylabel('Predicted Y')

plt.show()

The graph of actual and predicted house price for XGBoost.

Attention

All investments entail inherent risk. This repository seeks to solely educate

people on methodologies to build and evaluate algorithmic trading strategies.

All final investment decisions are yours and as a result you could make or lose money.